for financial advisers.

for financial advisers.

Give your clients access to high-yield term accounts that have been professionally structured by world class providers to deliver attractive and reliable monthly income fixed above the RBA cash rate.

Easy Set-Up & Access

Easy Client Onboarding

Seamless Management

Dedicated Support

Term Lengths and Target Rates

How much do you want to deposit?

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

Target Rates are set as a fixed margin above the RBA Cash Rate, which is variable over the course of the Term.

Floating-Rate, Fixed-Spread, Income Paid Monthly

Covering a large range of client accounts

Personal accounts

Joint accounts

Child accounts

Companies & trusts

SMSF investors

Capital Stability and Resilience through Global Private Credit

TermPlus returns are underpinned by an institutionally managed, highly diversified global private credit portfolio constructed with contractual legal protections in place that aim to safeguard both income and principal repayment, diversified across over 3,000 underlying investments.

You're in Good Company

Pengana Capital Group

TermPlus is brought to you by Pengana Capital Group, with over 20 years of experience in delivering distinct and differentiated investment strategies for high-yield outcomes, across a variety of Australian and Global sectors.

Mercer Australia

We have engaged global investments leader, Mercer, to provide TermPlus with access to a diversified portfolio of some of the best global private credit opportunities available.

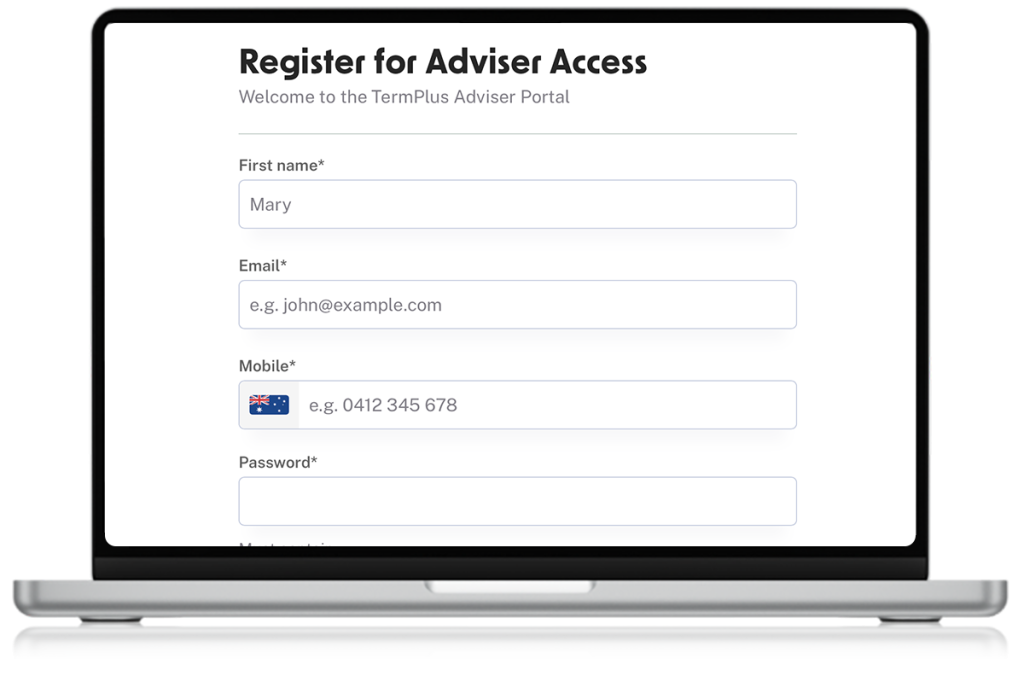

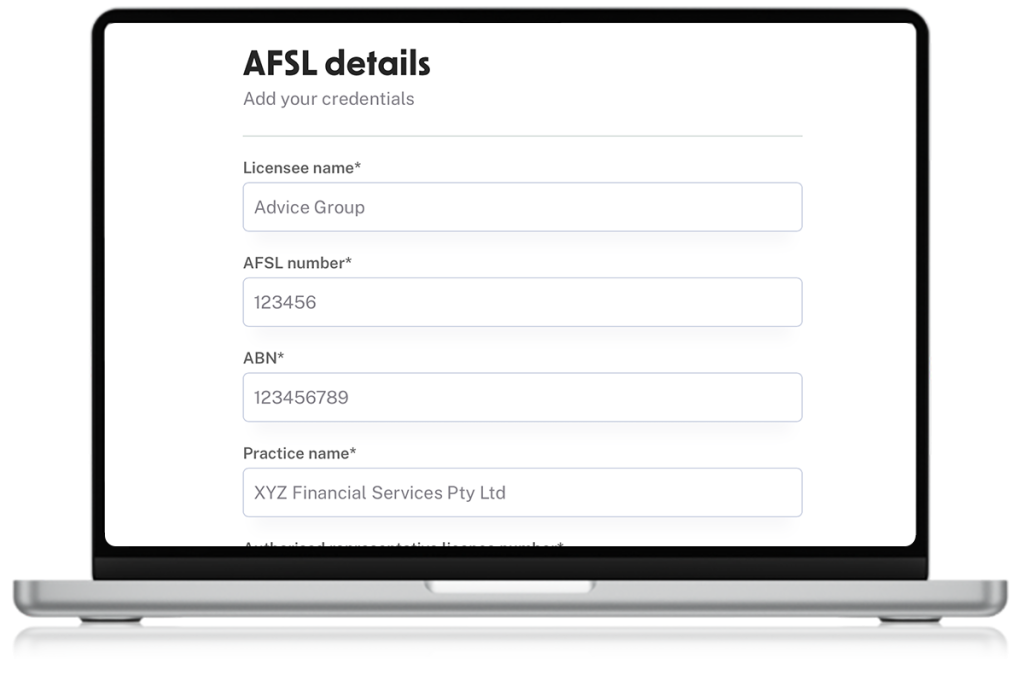

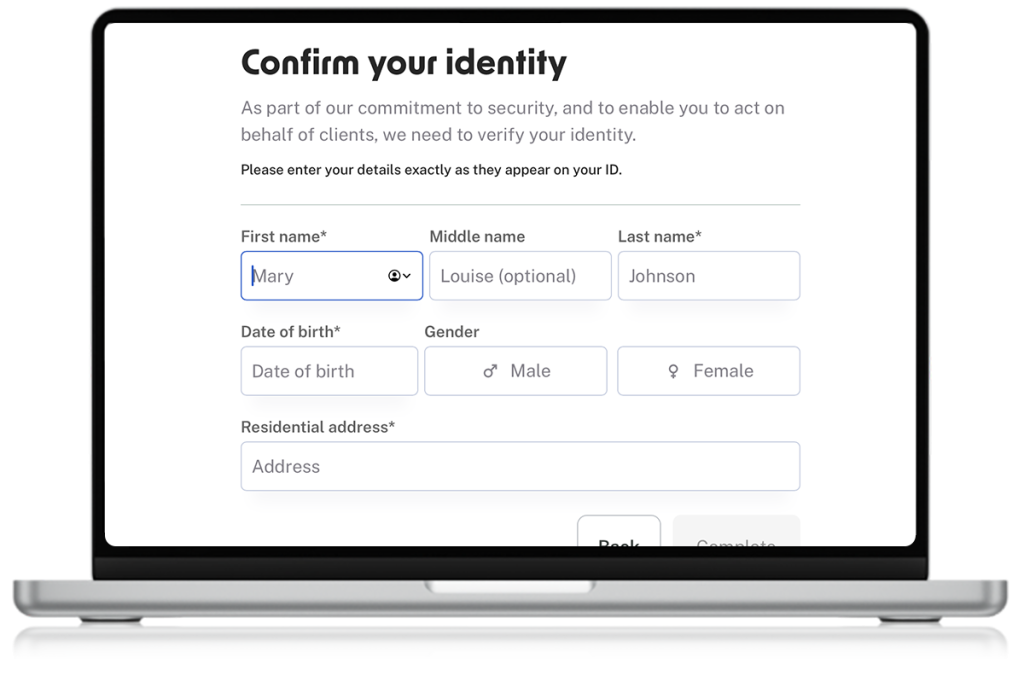

Set up your adviser dashboard in 3 simple steps.

At TermPlus, we’re committed to empowering financial advisers with the tools and resources to deliver exceptional outcomes for their clients.

Our adviser dashboard gives you complete access to create and tailor term accounts for your clients, with full visibility and account management tools. <<Watch the demo video here>>

1. Set up your login

2. Add your AFSL

3. Verify your identity

Why TermPlus for your clients?

Floating rate income with a set premium above RBA

Monthly income or reinvestment

Daily start - control maturity to align with client needs

SMSF, trust, individual and company accounts eligible

Minimum investment: $2,000

Maturity alerts and rollover support

Suitable for drawdown phase clients who want predictable, inflation-aware income with low volatility.

Reinvest option can support compounding in lower-risk sleeves of portfolios.

Works well as a parking solution when clients are in-between investments or divesting risk assets.

Useful for term-based planning (e.g. bridging to tax dates, property settlements, pension commencements).

Adviser Resources

Chat to a BDM

Ready to Register?

Need to Know More?

Click here to contact our client service team or simply call 1300 883 881 for assistance.

*Lonsec ratings issued 06/11/2025 are published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full

report. © 2025 Lonsec. All rights reserved.

For all important information regarding BondAdviser Product Assessments please see the final page of the BondAdviser Fund Report or visit www.bondadviser.com.au