TermPlus online term accounts are high-yield fixed-term investment accounts that offer better target rates for monthly income payments, which can be paid to your bank account, or reinvested.

There are several factors that we believe should give account holders confidence in putting their money to work with TermPlus. These factors span both the underlying assets that underpin the TermPlus income payments, as well as the built-in layers of protection applied to TermPlus accounts.

Ultimately, account holders are looking for confidence in two areas:

The stability of your TermPlus account balances

The reliability of TermPlus monthly income payments

The TermPlus portfolio

Lending is one of the world’s oldest asset classes.

Lending, in the form of Global Private Credit, is one of the world’s fastest–growing asset classes.

TermPlus returns are generated from a portfolio of over 2,000 loans to substantial multi-billion-dollar companies, diversified across industry and geography, with earnings typically between US$50 million and US$250 million.

Key characteristics of the TermPlus master portfolio

Structural tailwinds

Global private credit is a sector with significant structural tailwinds. Ongoing tightening of banking regulations since the Global Financial Crisis in 2008/2009 in overseas markets (particularly the US and Europe) has created a situation where the significant demand for credit [or loans] far outweighs the supply, as banks move further away from lending due to increasing regulatory constraints. This is evidenced in the rapid and exponential growth of the global private credit sector in recent decades, and is also part of the reason why global private lenders receive very attractive interest rates on loans.

Historical performance

Contractual Returns

Private credit loans are contractual, and contain interest and principal repayment terms, as well as lender protections which the borrower must meet. This means the lender has predictable interest payments and protections that work to minimise any potential loss. As the private credit loans underpinning the TermPlus portfolio are contractual in nature, there is a built-in level of certainty around future cashflows, which can also include characteristics such as floating interest rates and capital security.

Diversification

The TermPlus portfolio is made up of over 3,500 individual loans, and is constructed by global investment leader Mercer. Mercer has over US$16 trillion in assets under advice (latest figure available as at 30 June 2023). The 3,500+ loans provide a great level of diversification which adds additional stability to capital and returns by spreading investments across non-cyclical industries and reducing concentration risk in any borrower, market, region, or sector.

Senior Security

Private credit loans encompass both Senior Debt and Junior / Mezzanine Debt. These loan types typically make up between 45% to 70% of a company’s capital structure, with the remaining 30 to 55% typically being equity. Should a company experience financial difficulties or fail, the senior parts of the capital structure have priority over the assets. Senior Debt holders are entitled to the first-priority claim on assets, and all debt holders have priority over equity holders.

All other things being equal, this implies that a company would have to lose between 30% to 55% of its value before private credit loans would experience any capital losses.

Very low historical sector loss rates

Between 1995 and 2021, a period covering significant credit stress events including the GFC and COVID, private credit loans to US Middle Market corporates experienced a cumulative annual loss rate of less than 1.4%2. The loss rate is calculated as the percentage of loans that defaulted multiplied by the amount of the loan not recovered following a default.

As noted above, the long-term return on senior direct lending has been 9-10%3, with current returns meaningfully higher than this average due to relatively high interest rates. These returns are net of the losses mentioned above (<1.4%), meaning that loss rates have to increase substantially above historical averages before senior secured loans, and other forms of private debt, experience negative performance.

In addition to the structural and contractual protections in the global private credit sector, and the added risk minimisation that comes from our high level of diversification and investment selection…

Built-in layers of account protection

Our commitment to our customers.

TermPlus helps everyday Australians confidently put their savings to work through unique access to a diversified portfolio of global private credit funds managed by highly rated private credit fund managers, offering robust characteristics (as outlined below), and has been designed with 3 distinct built-in layers of account protection to attract investors.

These layers of protection are underpinned by our own investment in what is called the TermPlus Support Account.

The Support Account

Our commitment to our customers.

The Support Account is a co-investment that we make alongside Account Holders, put in place to underpin the 3 distinct built-in layers of protection provided for your savings.

Notably, your monthly income must be paid in full before the Support Account receives any allocation. In fact, term accounts have priority entitlement to any income earned by the Support Account in the previous 12 months to meet monthly returns. Our Savings Support mechanism provides a top-up if the total amount you receive back from your Term Account (including income payment paid out to you) is less than the amount you invested. Furthermore, it’s important to note that global private credit is generally uncorrelated with listed stock markets – that is, there is not a direct connection between stock market performance and private credit.

5% Saving Support

A top-up payment of up to 5% of your total invested amount at the end of your term.

As discussed above, when looking at the underlying engine that drives TermPlus Income Payments, the likelihood of negative performance, and therefore a decline in an account holder’s capital balance, is very low. To provide further protection, any decline in the amount you invest in TermPlus is eligible to be topped up by the Support Account at Maturity, up to a maximum of 5% of the total amount you invested (including any Income you have reinvested over the course of your term, but not including, and offset by, any Income already paid out to you during the course of your term).

Priority Income Entitlement

Customer priority over the income generated by the Support Account, if needed.

The Support Account, just like customer accounts, earns income on its invested balance. The difference is that TermPlus Customers have priority over income generated by the Support Account if ever it’s needed to support target rates. Think of it as an extra income pool of income that supports your monthly TermPlus account income.

Income Stabilisation

Anchored target rate calculations.

In the event that the value of your Term Account balance decreases for any given month, we will continue to calculate your Target Rate Income on the total Invested Amount (including any reinvestments of past Income).

We take a truly customer-first approach whereby TermPlus will only receive any return once account holders are delivered their full expected outcomes.

The combination of the structural characteristics of the underlying TermPlus assets, and the TermPlus layers of account protections, are core to our customer-first approach to delivering exceptional Term Accounts.

Term Lengths and Target Rates

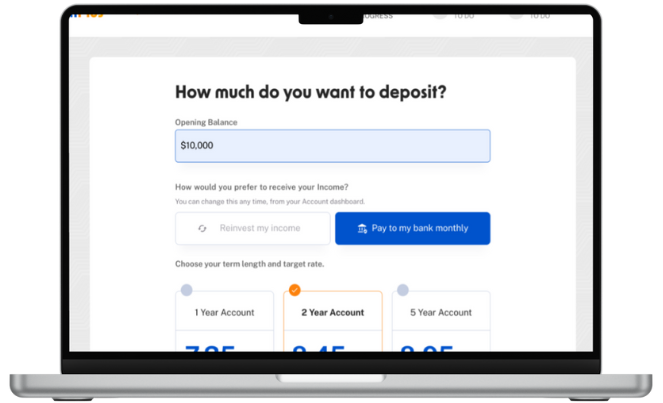

How much do you want to deposit?

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

Or try our Income Calculator

*Calculations provided are for indicative purposes only and have been subject to rounding adjustments. The above quoted Target Rates are those current as at today and are merely objectives, which may change during the course of the Term. Please refer to the Product Disclosure Statement (‘PDS’) for TermPlus for an explanation of the Target Rates and other terms used on this website. Any revised Target Rate for each Term will be detailed on the website: www.termplus.com.au and applied to both new and existing Term Accounts. There is a risk that TermPlus may not be successful in achieving the Target Rates. Whilst TermPlus Accounts provide for Priority Income Entitlement, Income Stabilisation and Savings Support (‘Support Mechanisms’) to support the delivery of TermPlus Account objectives, none of Pengana Capital Limited (and Pengana Credit Pty Ltd) and their associates, shareholders, agents, managers, advisers or delegates guarantee the performance of TermPlus. Account Holders’ capital is not guaranteed. Like all investments, even with Support Mechanisms, TermPlus’ investments carry risks, and if these risks eventuate, Account Holders may lose some or all of their capital invested in TermPlus. The Target Rate is not guaranteed, is not a forecast, and may not be achieved. The Target Rates are calculated off the RBA Cash Rate plus a fixed percentage spread. The RBA Cash Rate can change from time to time. An investment in an Account is not a bank deposit or a term deposit with a bank. Past performance is not a reliable indicator of future performance. The Target Rate is a net amount. The financial product described herein will be issued by Pengana Capital Limited in its capacity as trustee of TermPlus ARSN 668 902 323. Before deciding whether to acquire, or to continue to hold the product, you must read the PDS available on this website and consider whether the product is right for you. You should also read the Target Market Determination which describes who the financial products mentioned herein, may be appropriate for.

Accounts Are for

Accounts Are for

All Sorts of Savings

Start earning with balances from $2,000

Personal accounts

Joint accounts

Child accounts

Companies & trusts

SMSF investors

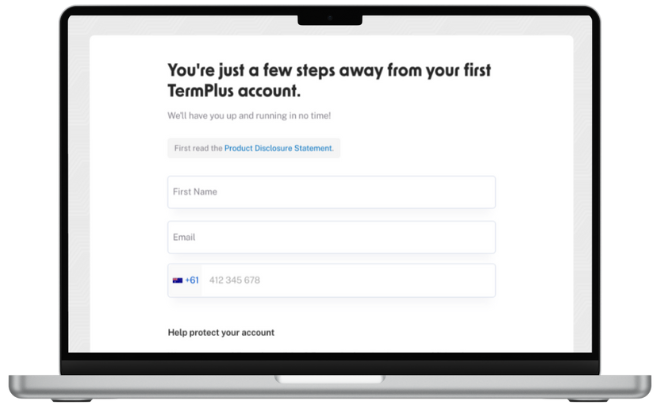

Getting Started Is Easy

1. Verify your details

Confirm your identity and select your account type.

2. Tailor your Term

Choose your investment amount, Term and Income preference.

3. Deposit your funds

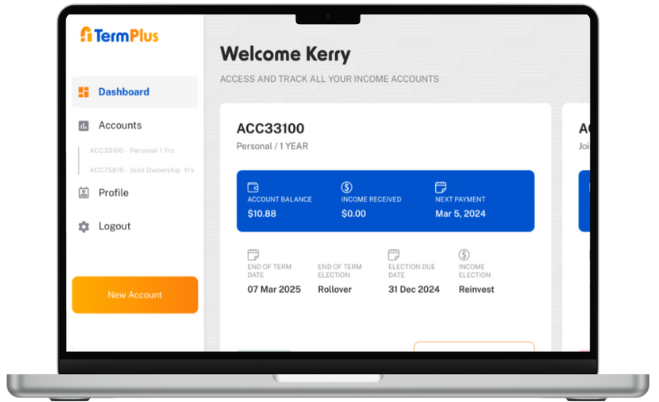

See your savings go to work for you, month-to-month.

A comprehensive summary of the risks to consider when investing in TermPlus is set out in the TermPlus PDS.

1. Returns in USD. 10 year period from 1 July 2013 to 30 June 2023. Sources: S&P (S&P 500 Total Return Index), Bloomberg (Bloomberg US Corporate Total Return Value Unhedged USD), Burgiss (Burgiss – Private Debt (North America)), and Thomson Reuters Datastream (ICE BofAML US High Yield Master II, S&P Leveraged Loan). S&P, Bloomberg, Burgiss and Thomson Reuters have not provided consent to the inclusion of statements utilising their data. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily a guide to future performance.

2. Sources:

• USD$ Cumulative Default Rate 1995 – 2021: S&P LCD & CreditPro (1995 to 2021), as at 31 December 2021. The cumulative default rate is the percentage of commercial borrowers within a certain category that have defaulted on their obligations by a specific point in time. It is the total number of defaults accumulated over a period, expressed as a percentage of the initial loan pool. This metric helps investors and analysts to assess the historical default likelihood of borrowers within a specific category over different timeframes. The S&P LCD cumulative default rate has a one-year lag since it assumes a loan will not default within one year of origination. Past performance is not a reliable indicator of future performance and may not be repeated.

• USD$ Average Annual Recovery Rate 1995-2022: S&P LCD & CreditPro (1995 to 2022). The Annual Recovery Rate is the average percentage of the loan principal amount recovered by lenders following a default event within a specific year. This metric provides insight into the expected loss in case of a default, showing how much lenders might recoup on their investments on average. Middle market loans defined as those <$500m in size. Past performance is not a reliable indicator of future performance and may not be repeated.

S&P LCD & CreditPro have not provided consent to the inclusion of statements utilising their data. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily a guide to future performance.

3. Source: Private credit annualised yields to maturity are estimates based on Mercer analysis on the basis that such loans are held to maturity. Mercerhas not provided consent to the inclusion of statements utilising their data. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily a guide to future performance.

Pengana Capital Limited (ABN 30 103 800 568, AFSL 226566) (“Pengana”) is the issuer of units (“Term Accounts”) in TermPlus (ARSN 668 902 323) (“TermPlus”). The offer of Term Accounts in TermPlus will be made in the Product Disclosure Statement for TermPlus (“PDS”). The PDS and the Target Market Determinations for TermPlus can be obtained by contacting TermPlus on 1300 883 881 or from www.termplus.com.au. A person should consider the PDS in deciding whether to acquire, or to continue to hold, Term Accounts in TermPlus. This document was prepared by Pengana and does not contain any investment recommendation or investment advice.TermPlus offers broad exposure to the Global Private Credit asset class, investing overseas in Western Europe and the US, and also to a lesser extent in Australia. The asset class exposure is diversified by Underlying Manager, strategy, geography, sector, credit quality and type of instrument.

The performance of, or the repayment of capital, or income invested in TermPlus is not guaranteed. An investment in TermPlus is subject to investment risk including a possible delay in repayment and loss of income and principal invested. Past performance is not a reliable indicator of future performance and may not be repeated.Mercer Consulting (Australia) Pty Ltd (MCAPL) ABN 55 153 168 140, Australian Financial Services Licence #411770.

‘MERCER’ is a registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.This document has been prepared without taking into account any person’s investment objectives, particular needs or financial situation. It is general information only and should not be considered investment advice and should not be relied on as an investment recommendation. Before acting on any information contained within this document a person should consider the appropriateness of the information, having regard to their objectives, financial situation and needs.

Certain expressions used in this document have defined meanings which are in the PDS.If you are interested in keeping up to date with our content, you are welcome to subscribe to our newsletters from our website www.TermPlus.com.au