Getting on Good Terms with Money

How We Put Your Savings to Work

TermPlus helps everyday Australians confidently put their savings to work.

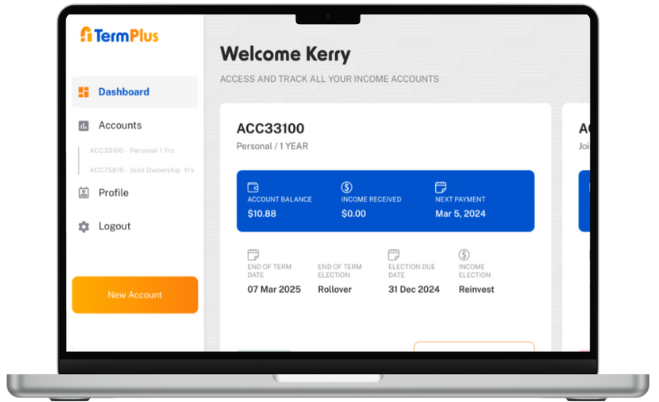

Open an online term account that offers better target rates for monthly income payments, which can be paid directly to your bank account, or reinvested for compounding earnings.

TermPlus aims to deliver stability of capital and reliability of income to account holders via 3 distinct layers of account protections.

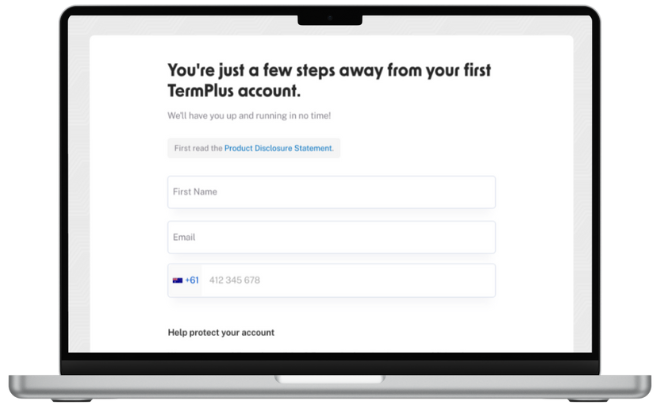

Kick-start your savings in a few simple steps

- Apply online: Get started with ease using our intuitive online app. Our step-by-step process guides you through selecting your preferred account options.

- Get verified: We prioritise your security. Complete an ID verification step to ensure your account protection and compliance.

‘Term’ is money!

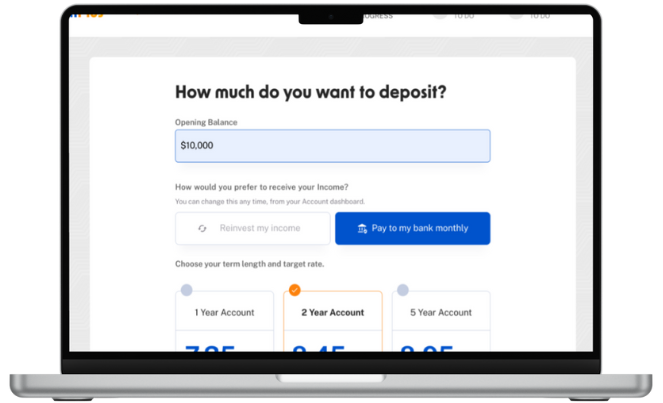

Select the length of your income Term based on your financial goals

- Shorter-term option: Opt for a 12-month term for quicker access to your funds, while still enjoying significant reward targets.

- Longer-term option: Lock in your savings for longer to unlock bigger rewards, whether it’s for retirement, future investments, or fulfilling your financial aspirations.

Add your bank account

Link your nominated bank account to transfer your Term Account balance. This is also the account that will receive your monthly income (should you choose to have it paid to your bank).

Take control of your earnings with flexible options

Choose your income method: Decide whether to reinvest your earnings for long-term growth, or receive monthly payments to supplement your income.

- Reinvest: Watch your earnings compound over time by reinvesting them into your account balance.

- Monthly income: Receive regular income payments directly to your bank account for ongoing cash flow. A great feature not only for retirees, this might be suitable for supplementing income or meeting short-term financial needs.

Explore your options as your Term comes to an end

- Withdraw funds: If you’re ready to cash out at the end of your Term, simply elect to withdraw your funds at maturity.

- Keep it rolling: Keep the income flowing by automatically rolling your money into a new Term of your choice.

- Partial rollover: Draw some funds to enjoy immediately, while reinvesting the rest into a new term, giving you the best of both worlds.

Why Smart Australian Investors Are Choosing TermPlus

1. Higher Target Rates for Real Growth

TermPlus offers target rates starting from 6.85% p.a for investors who want to put their savings to work, and outpace inflation with real growth. You can use your term account to generate steady monthly income, or re-invest and compound your income payments.

2. Easy Online Setup in Minutes

Forget the hassle of endless paperwork and confusing forms. At TermPlus, you can open your account online in as little as 3 minutes. The experience is seamless, fast, and stress-free. From setting your account up to tracking your earnings.

3. Professionally Constructed Investments for Extra Security

Unlike many investment options, TermPlus supports your earnings, with our own co-investment into a Support Account. That’s how we deliver a 3-layer protection system on your income and capital. We’re also powered by ASX-listed Pengana Capital Group, in association with investment leader Mercer. All with the aim of providing access to competitive returns consistently.

4. Access to Exclusive Global Opportunities

TermPlus gives you access to a highly diversified, professionally constructed, global private credit portfolio. This kind of access is usually reserved for large institutional investors. Now, everyday Australians can enjoy these same opportunities to grow their wealth.

20+ Years of Experience

Powered by Pengana Group in association with Mercer Australia.

3-Layer Protection System

Term Lengths and Target Rates

How much do you want to deposit?

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

Target Rates are variable over the course of the Term, linked to the RBA cash rate plus a fixed spread.

Global Private Credit Explained

A lot goes into creating term-based accounts that liberate the way you earn, with a Target Rate that aims high. To unlock the big-money-advantage for all Aussies, TermPlus taps into the dynamic and diverse world of Global Private Credit, for Target Returns that seek to deliver a set amount above the cash rate.

TermPlus is powered by Pengana Capital Group, and our alliance with Mercer. Using their infrastructure and reach, we access Pengana’s best-of-breed private global private credit Master Trust, for diverse returns you can count on

We bring this to you effortlessly, carrying you closer to your financial goals, as your money starts making money.

‘Lending’ is one of the world’s oldest asset classes.

Lending, in the form of Global Private Credit, is one of the world’s fastest–growing asset classes.

When we talk about global private credit, we are generally referring to non-bank direct lending to medium-sized companies (with annual earnings up to US$250m). These loans are :

- contractual

- individually customised,

- senior in the capital structure (meaning they rank above other debt or equity)

- have security over physical or financial assets, and

- are held to maturity or refinanced.

For a detailed overview of global private credit, Click HERE >>

TermPlus returns are generated from a highly diversified portfolio of over 4,500 global private credit investments.

Global private credit can offer attractive risk-adjusted returns compared to traditional fixed income. Our Master portfolio employs different kinds of private credit to combine the stable yields from direct lending, with other forms of private credit such as structured credit and specialty finance, which provide diversification and varied investment strategies.

Managed by Pengana Credit, TermPlus offers access to a highly diversified, multi-manager, multi-strategy, global private credit portfolio, designed to deliver both higher yields and a stable capital base.

This portfolio forms the basis for TermPlus Accounts.

In addition, TermPlus offers mechanisms designed to offer an added layer of Income and Savings support to Account Holders in order to further mitigate the risk that the value of your investment may fall. We invest in a globally diversified portfolio managed by highly rated private credit fund managers, prioritising capital-efficient strategies and asset-sourcing advantages. Pengana Capital Limited acts as the Responsible Entity, overseeing TermPlus with Mercer Consulting as the Investment Consultant.

Supporting Your Savings

We’re committed to helping you with your financial journey, which is why we have 3 distinct built-in layers of protection for every TermPlus Account.

These layers of protection have been designed with the objective of offering reliability of Income, and stability of capital, to Account Holders.

Our commitment to you.

The Support Account is an investment alongside Account Holders put in place to underpin the 3 distinct built-in layers of protection provided for your savings.

The Support Account cedes priority of both its capital and income to account holders, in order to further support customer capital and income.

The value of the Support Account will be equal to at least 5% of the aggregate value of the total Invested Amount of all Term Accounts (less any Savings Support payments in the event they are made to Term Account holders – none have been needed to date).

Customer priority over the income generated by the Support Account, if needed.

Your Income comes first.

Because we’re committed to supporting your saving journey, we have built in a Priority Income Entitlement mechanism to TermPlus.

The Support Account, just like TermPlus Customer accounts, earns income on its invested balance. Any income the Support Account has generated in the last 12 months is available to top up your monthly Income for any given month, if returns fall short. Think of it as an extra income pool that works to maintain Target Rates and returns for your account in the event of an earning deficit.

Anchored target rate calculations. Because reliability matters.

In the event that the value of your Term Account balance was to decrease during the course of your Term, your Income for subsequent months will continue to be calculated based on the total amount you have invested in your account, inclusive of any Income you’ve reinvested.

The monthly payment of accrued Target Rate Income is not guaranteed and is subject to TermPlus generating sufficient return.

A top-up payment of up to 5% of your total invested amount available at the end of your term. A layer of protection for your savings.

Our money where our mouth is.

In addition to the two layers of Priority Income Entitlement and Income Stabilisation, TermPlus provides an added layer of protection that we call ‘Savings Support’ which aims to keep your savings intact.

During the Term: if the Closing Balance of your Term Account on any given month falls below the amount you have invested (including your initial investment plus any reinvested income), any excess return for the Fund (after meeting all Target Rates for the month) is allocated pro-rata to all accounts until all Term Account balances have been restored to their Invested Amounts.

End of Term: if, at the end of an Account Holder’s Term (‘Maturity’), the Closing Balance of a Term Account plus Income paid or accrued to the Account Holder over the Term (‘Final Value’) is any less than the total Invested Amount (including reinvested income), our Savings Support then leaps into action, to provide a layer of protection. We will make a Savings Support payment to cover any shortfall of up to 5% of the Invested Amount towards restoring the Final Value of the Account back up to the Invested Amount.

We have made a commitment that the Support Account will be maintained at least at a minimum balance of 5% of the aggregate value of the total Invested Amount of all Term Accounts, less any Savings Support payments that have been made. Savings Support cover will be applied to the extent the Support Account has sufficient funds.

Customer Satisfaction Is Our Priority

At TermPlus your satisfaction is our top priority. We’re committed to clear, compelling Target Rates and flexible options, ensuring our terms are transparent and easy to understand, along with market-leading features and benefits. You’ll always find dependable support, and account security that keeps your money safeguarded at all times. We aim to exceed expectations by providing a secure and seamless investment experience, helping you achieve your financial goals with confidence.

Getting Started Is Easy

1. Verify your details

Confirm your identity and select your account type.

2. Tailor your Term

Choose your investment amount, Term and Income preference.

3. Deposit your funds

See your savings go to work for you, month-to-month.

Download Our PDS

If you’re looking for a comprehensive understanding of our products and services, simply access our Product Disclosure Statement (PDS). The PDS covers off all your options, helping you make informed decisions about putting your savings to work with TermPlus.

You can find the PDS on our website or request a copy through customer support. We’re committed to ensuring you have all the information you need to confidently navigate your investment journey with us.