Global Private Credit

Private credit refers to loans made to businesses by non-bank lenders, such as by specialist investment funds, rather than traditional banks. These contractual and secured loans are not traded on public markets and are often negotiated directly between the borrower and the lender. It is considered part of the ‘private markets’ asset class, along with private equity, infrastructure, and real estate.

Private credit includes loans that might help businesses grow, buy other companies, leverage their assets, or manage their cash flow. Globally, private credit has been one of the fastest growing asset classes over the last 15+ years, but has largely been accessed exclusively by large institutional investors… UNTIL NOW.

You're in Good Company

Powered by

Pengana Capital Group

TermPlus is brought to you by Pengana Capital Group. As an ASX-listed funds manager founded in 2003, Pengana’s is highly regarded for it’s innovative history in delivering distinct and differentiated investment strategies for high-yield outcomes, across a variety of Australian and Global sectors.

In association with

Mercer Australia

Mercer is a global investment leader with over 2,000 investment professionals around the globe, and more than 30 years’ experience in private markets, with 260 alternatives professionals based in approximately 30 offices around the world.

This association with Mercer enables TermPlus to deliver a diverse portfolio of best-of-breed global private credit opportunities for our customers.

The key difference is who is providing the loan and how it’s structured:

– Private credit is arranged directly between investors and businesses, usually through private funds. The loans are not listed or traded on public markets. Because they are managed until repaid in full, private credit funds are selective about who they lend to, conducting thorough due diligence and seeking to negotiate contractual protections to minimize the probability any borrower is unable to make interest payments and/or repay the loan amount

– Public credit (like bonds) is issued by companies or governments and traded on open markets like the ASX or NYSE, making them more liquid. Banks will arrange these loans on behalf of the borrower, who is seeking the best terms, e.g., lowest interest rate and least restrictions, and will distribute the loan to investors for a fee. They typically do not hold the loans, and so do not bear the risk of repayment obligation.

Global private credit is private credit that spans across international markets, particularly the US and Europe. It includes lending to companies outside Australia, often through large global funds. These funds may lend to thousands of businesses across different regions, industries, and credit types.

In the context of TermPlus, when we talk about the global private credit sector, we are primarily referring to non-bank loans to mid-market companies (i.e. typically earning between USD $50 million to $250 million in annual profit (EBITDA)).

Global private credit has quadrupled over the past decade, reaching over USD $1.7 trillion1. This growth is driven by:

– Investors seeking the higher, more stable income offered by global private credit, in a low-interest rate world.

– Banks stepping back from lending, especially since the Global Financial Crisis, due to liquidity challenges in the banking model, and tighter regulations as a result.

– Borrowers turning to private lenders as an attractive alternative to bank financing.

In the wake of the Global Financial Crisis, regulators tightened capital and liquidity rules for banks. Those stricter requirements made long-dated loans (maturities over three years) to mid-market companies more capital-intensive and less attractive for banks. The resulting funding gap would be (and continues to be) filled by private credit funds, which are able to provide the longer-term financing banks are no longer able to hold.

Borrowers are usually middle-market companies – not huge corporations, but solid businesses typically earning between USD $50 million to $250 million in annual profit (EBITDA). These companies may use the loans for growth, acquisitions, special projects, or refinancing existing debt.

Investors are drawn to global private credit for several reasons:

– Attractive returns: Higher income compared to many traditional investments.

– Stability: Historically lower volatility than shares or bonds.

– Diversification: It behaves differently from traditional markets, helping to diversify risk.

– Capital preservation: Well-structured loans are often secured and offer protections for lenders.

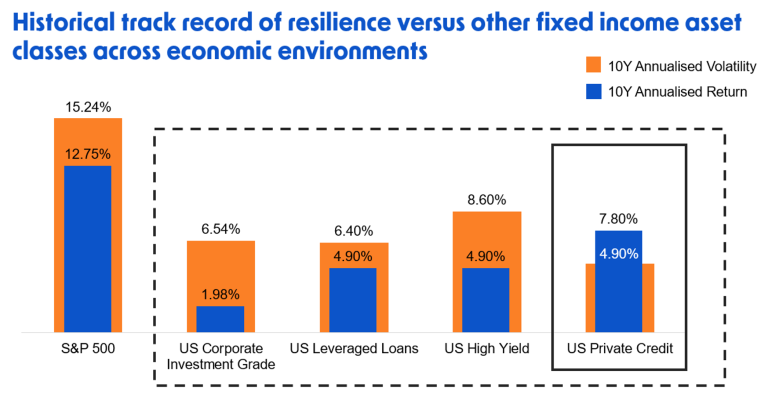

Global private credit has historically delivered stronger returns and lower volatility than other traditional fixed income investments, including during challenging economic periods, and without stock market volatility.

While it’s important to note that past performance is not a reliable indicator of future performance, and the value of all investments can go up or down, the three layers of protection offered by TermPlus can help fund monthly payments and repayment of your investment.

Historically, global private credit has primarily been used by large institutional investors such as:

– Superannuation funds (Australian super funds have doubled their private credit allocation since 2018)

– Sovereign wealth funds

– Insurance companies

– Institutional Wealth advisers

TermPlus is a fundamentally different term account product, and a unique access point to the world of global private credit for everyday Australians.

Many super funds and institutional investors continue to increase their allocation to global private credit, while the number of new products enabling individuals access continues to grow. The ongoing pullback by banks, combined with strong demand from borrowers and investors, suggests that growth in the sector is likely to continue, supported by significant structural tailwinds.

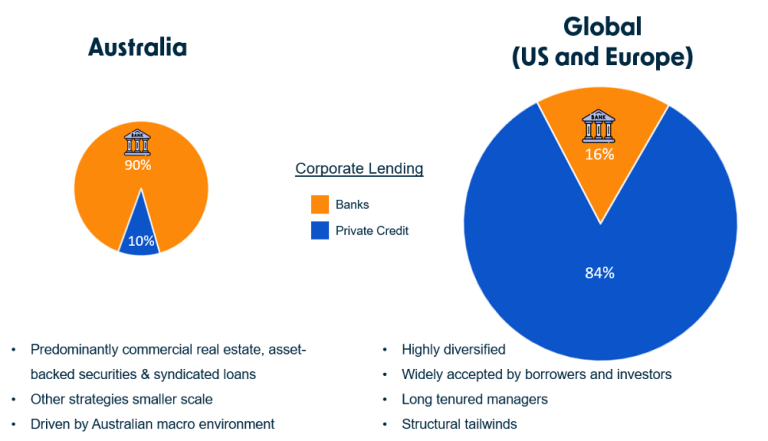

Australian private credit is part of the same asset class, but:

– The market is smaller and less developed than those in the US or Europe.

– There are fewer opportunities and less diversification available locally.

– The local market is dominated by real estate lending, which is a small part of the market overseas.

Private credit makes up just 10% of the lending market in Australia, where as globally, private credit accounts for 84% of the lending markets.

Here’s why an investor might consider it:

– Income: private credit typically provides a stable income stream that is typically a fixed spread above the benchmark cash rate.

– Diversification: Exposure to thousands of loans across regions and sectors reduces risk.

– Low volatility: More stable than many traditional market investments.

– Access: TermPlus offers access to global private credit managers that individual investors couldn’t usually reach.

– Liquidity: Even though the loans are illiquid, investment vehicles listed on the ASX allow investors to buy or sell units (subject to market demand).

While global private credit displays attractive characteristics such as low volatility and diversification, all investments involve some level of risk.

Some of the key risks include:

– Credit risk: Borrowers may default on their loans.

– Market risk: Broader economic or geopolitical events can impact returns.

– Valuation risk: Many loans are illiquid and hard to price.

– Currency risk: Investments are mostly overseas, and currency movements may affect returns (though the Trust uses hedging to substantially eliminate this).

– Manager risk: The performance depends on the skill of underlying fund managers.

TermPlus works closely with appointed investment consultant Mercer, a global investment leader (responsible for over USD $16 Trn in assets under advice).

Through Mercer, TermPlus aims to mitigate investment risks through its portfolio construction and diversification across over 4,500 underlying loans. This is achieved through identifying and accessing highly rated private credit managers, with strong track records of performance through market cycles, and diversifying the portfolio which purposefully spans defensive, non-cyclical industries, geographies and strategies and is hedged to mitigate any currency risk.

No, the investment may not be suitable for:

– People seeking short-term returns, or short term access to all of their capital, given it is a relatively illiquid investment.

This is also true in relation to the nature of the fixed-term lengths of TermPlus term accounts.

1. Source: Source: Preqin.. Horizontal axis covers the period between 31 December 2000 and 30 June 2023.

2. Returns in USD. 10 year period from 1 July 2013 to 30 June 2023. Sources: S&P (S&P 500 Total Return Index), Bloomberg (Bloomberg US Corporate Total Return Value Unhedged USD), Burgiss (Burgiss – Private Debt (North America)), and Thomson Reuters Datastream (ICE BofAML US High Yield Master II, S&P Leveraged Loan). S&P, Bloomberg, Burgiss and Thomson Reuters have not provided consent to the inclusion of statements utilising their data. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily a guide to future performance.

“Annualised Standard Deviation” is a measure of how much the price of an asset or the return of a portfolio of assets has fluctuated (both up and down) over a certain period. If an asset or portfolio of assets has a high Annualised Standard Deviation the price of the asset or return of the portfolio of assets has historically fluctuated vigorously. If an asset or portfolio of assets has a low Annualised Standard Deviation, the price of the asset or return of the portfolio of assets has historically moved at a steady pace over a period of time.

3. Past performance is not necessarily a reliable indicator of future performance.

Need to Know More?

Click here to contact our client service team or simply call 1300 883 881 for assistance.