Better Returns

from Your Savings

It's About Time!

Get your money to work for you, with our fixed-term accounts.

Powered by Pengana Capital Group, with 20+ years of investment excellence, in association with Mercer.

Easy online application

Linked to the RBA cash rate

Income paid monthly

As featured in:

Accounts Are for

Accounts Are for

All Sorts of Savings

TermPlus is not a bank. We exist to unlock the ‘big money advantage’ for everyday Australians through access to a highly-diversified, multi-manager, multi-strategy, portfolio of global private credit funds managed by highly rated private credit fund managers primarily in the US, and Europe.

Start earning with balances from $2,000

Personal accounts

Joint accounts

Child accounts

Companies & trusts

SMSF investors

Term Lengths and Target Rates

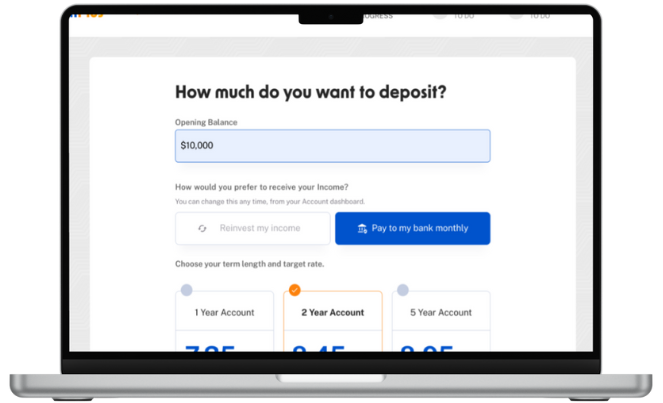

How much do you want to deposit?

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

Or try our Income Calculator

* The above quoted Target Rates are those current as at today and are merely objectives, which may change during the course of the Term. Please refer to the Product Disclosure Statement (‘PDS’) for TermPlus for an explanation of the Target Rates and other terms used on this website. Any revised Target Rate for each Term will be detailed on the website: www.termplus.com.au. There is a risk that TermPlus may not be successful in achieving the Target Rates. The Target Rates are calculated off the RBA Cash Rate plus a fixed percentage spread. The RBA Cash Rate can change from time to time. An investment in a Term Account is not a bank deposit or a term deposit with a bank.

It's About Term!

Earn up from the cash rate

Our Target Rates are variable over the course of the Term, linked to the RBA cash rate plus a fixed spread.

Choose how you’re paid

Have your monthly Income paid to your bank, or reinvest it for compound returns. It’s all too easy.

Compound your earnings

Built-in layers of account protection

We support your Term Accounts with 3 distinct built-in layers of protection.

Income Calculator

How much do you want to deposit?

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

(includes reinvested Target Total Income)

How would you prefer to receive your Income?

my income

bank monthly

- Earns income daily

- Paid to you monthly

- Built-in Savings Support

*Calculations provided are for indicative purposes only and have been subject to rounding adjustments. The above quoted Target Rates are those current as at today and are merely objectives, which may change during the course of the Term. Please refer to the Product Disclosure Statement (‘PDS’) for TermPlus for an explanation of the Target Rates and other terms used on this website. Any revised Target Rate for each Term will be detailed on the website: www.termplus.com.au and applied to both new and existing Term Accounts. There is a risk that TermPlus may not be successful in achieving the Target Rates. Whilst TermPlus Accounts provide for Priority Income Entitlement, Income Stabilisation and Savings Support (‘Support Mechanisms’) to support the delivery of TermPlus Account objectives, none of Pengana Capital Limited (and Pengana Credit Pty Ltd) and their associates, shareholders, agents, managers, advisers or delegates guarantee the performance of TermPlus. Account Holders’ capital is not guaranteed. Like all investments, even with Support Mechanisms, TermPlus’ investments carry risks, and if these risks eventuate, Account Holders may lose some or all of their capital invested in TermPlus. The Target Rate is not guaranteed, is not a forecast, and may not be achieved. The Target Rates are calculated off the RBA Cash Rate plus a fixed percentage spread. The RBA Cash Rate can change from time to time. An investment in an Account is not a bank deposit or a term deposit with a bank. Past performance is not a reliable indicator of future performance. The Target Rate is a net amount. The financial product described herein will be issued by Pengana Capital Limited in its capacity as trustee of TermPlus ARSN 668 902 323. Before deciding whether to acquire, or to continue to hold the product, you must read the PDS available on this website and consider whether the product is right for you. You should also read the Target Market Determination which describes who the financial products mentioned herein, may be appropriate for.

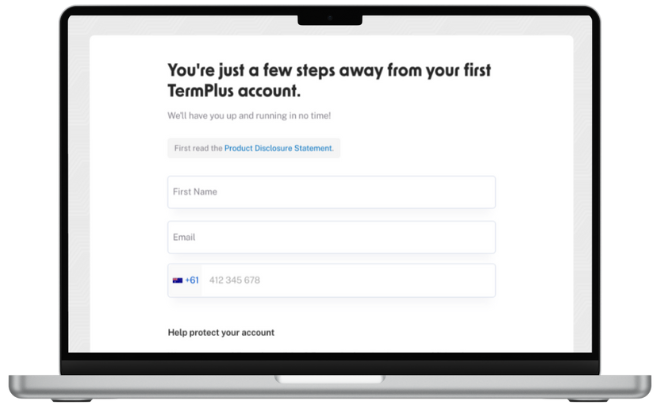

Getting Started Is Easy

1. Verify your details

Confirm your identity and select your account type.

2. Tailor your Term

Choose your investment amount, Term and Income preference.

3. Deposit your funds

See your savings go to work for you, month-to-month.

Your Money, Making Money

- Let your savings generate wealth for you.

- Unlock monthly passive income.

- Designed with the aim of providing stability of capital and reliability of Income.

Make your money work harder!

We Aim to Please

Backed by industry-leading partners with decades of experience and global reach, TermPlus delivers a robust solution for putting your savings to work.

20+ years investing for Australians

“At last, there’s an option that makes me feel sure about how I handle my extra savings on behalf of my kids.”

Candy W, 41 (NSW)

“Moving into retirement, I have a more predictable stream of monthly income that I can rely on.”

Jeff F, 72 (NSW)

Your Data Is Important to Us

Two-factor authenticated accounts

KYC/KYB/AML compliant

Data encryption

No fuss

No fuss

Built with You in Mind

Created by Pengana Capital Group and powered by Mercer, TermPlus taps into the dynamic world of global Private Credit to deliver leading Term Accounts with built-in layers of protection for its customers.

- Get more from your money

- Save for retirement

- Plan your next big getaway

- Make the home extension happen

- Put away for a rainy day

- Get closer to that dream purchase

- Fund your retirement lifestyle with generous and reliable Target Rates

*Source: BCG consumer sentiment survery September 2023.

Supporting Your Savings

We’re committed to helping you with your financial journey, which is why we have 3 distinct built-in layers of protection for every TermPlus Account.

These layers of protection have been designed with the objective of offering reliability of Income, and stability of capital, to Account Holders.

Our commitment to you.

The Support Account is an investment alongside Account Holders put in place to underpin the 3 distinct built-in layers of protection provided for your savings.

The value of the Support Account will be equal to at least 5% of the aggregate value of the total Invested Amount of all Term Accounts (less any Savings Support payments in the event they are made to Term Account holders – none have been needed to date).

Your Income comes first.

Because we’re committed to supporting your saving journey, we have built in a Priority Income Entitlement mechanism to TermPlus. Any income the Support Account has generated in the last 12 months is available to top up your monthly Income for any given month, if returns fall short. Think of it as an extra income pool that works to maintain Target Rates and returns for your account in the event of an earning deficit.

Because reliability matters.

In the event that the value of your Term Account balance decreases during the course of your Term, your Income for subsequent months will continue to be calculated based on the amount you initially invested for the Term, inclusive of any Income you’ve reinvested.

The monthly payment of accrued Target Rate Income is not guaranteed and is subject to TermPlus generating sufficient return.

Our money where our mouth is.

A layer of protection for your savings.

In addition to the two layers of Priority Income Entitlement and Income Stabilisation, TermPlus provides an added layer of protection that we call ‘Savings Support’ which aims to keep your savings intact.

During the Term: if the Closing Balance of your Term Account on any given month falls below the amount you have invested (including your initial investment plus any reinvested income), any excess return for the Fund (after meeting all Target Rates for the month) is allocated pro-rata to all accounts until all Term Account balances have been restored to their Invested Amounts.

End of Term: if, at the end of an Account Holder’s Term (‘Maturity’), the Closing Balance of a Term Account plus Income paid or accrued to the Account Holder over the Term (‘Final Value’) is any less than the total Invested Amount (including reinvested income), our Savings Support then leaps into action, to provide a layer of protection. We will make a Savings Support payment to cover any shortfall of up to 5% of the Invested Amount towards restoring the Final Value of the Account back up to the Invested Amount.

We have made a commitment that the Support Account will be maintained at least at a minimum balance of 5% of the aggregate value of the total Invested Amount of all Term Accounts, less any Savings Support payments that have been made. Savings Support cover will be applied to the extent the Support Account has sufficient funds.

Frequently Asked Questions

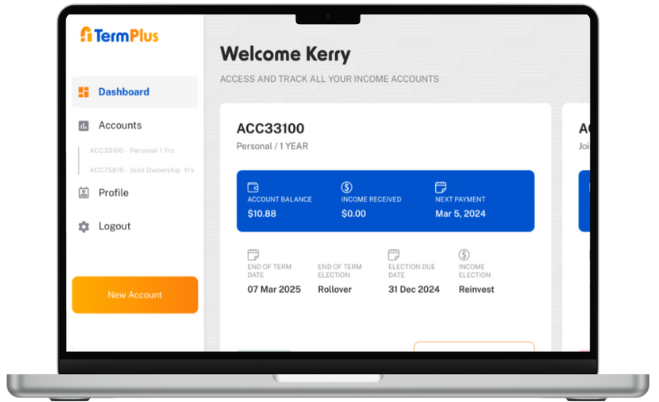

You have two choices on how to receive your monthly Income.

- Reinvest: Add it back into your account balance to earn additional Income. Reinvested Income will receive the same Target Rate, Maturity Date and layers of Protections as your Opening Balance.

- Pay to bank: We pay it to your linked bank account every month.

Simply make your election in your account dashboard.

You can change your election at any time during the month. Just make sure you make your election at least 5 business days before month-end for your preference to be updated, otherwise, it will apply to the one after that.

Your Income comes first.

Target Rates are not guaranteed, are not forecasts and may not be achieved. However, to provide reliability of Income, we invest our own money alongside Account Holders, in what we call a Support Account.

The Support Account seeks to provide reliable Income via two layers of protection.

1. Priority Income Entitlement

Because we’re committed to supporting your saving journey, we have built in a Priority Income Entitlement mechanism to TermPlus. Any income the Support Account has in the last 12 months is available to top up your monthly Income for any given month, if returns fall short. Think of it as an extra income pool that works to maintain Target Rates and returns for your account in the event of an earning deficit.

2. Income Stabilisation

In the event that the value of your Term Account balance decreases, your Target Rate Income for subsequent months will still be calculated based on the amount you initially invested for the Term, plus any Income you’ve reinvested, rather than your balance. This customer-first approach means more stable and reliable Income.

The monthly payment of accrued Income is not guaranteed and is subject to TermPlus generating sufficient return.

To keep Target Rates relevant, our accounts rates aim to deliver a set amount above the Reserve Bank of Australia’s Official Cash Rate (“Cash Rate”). Each Term has a specific Income objective calculated by reference to the Cash Rate, plus a fixed spread. If the Cash Rate changes, our Target Rates change in line with the Cash Rate.

The Target Rate is expressed on an annualised basis, net of any fees and costs.

The underlying master portfolio of global investments that is used to achieve the Target Rates paid to TermPlus accounts pays fees to underlying fund managers. These fees may impact the Income paid by TermPlus.

For a breakdown of fees and costs please refer to the PDS.

All investments carry some form of risk. In the event that the value of your Term Account balance was to decrease during the course of your Term, any excess TermPlus Return in following months (after paying that month’s Target Rates to Account Holders) is further allocated pro-rata across all accounts until the value of each Term Account is back to its total Invested Amount.

At the end of your Term, if the Closing Balance of your Term Account, plus any Income that has been paid or accrued to you, is still lower than your total Invested Amount, TermPlus goes one step further by building in an additional layer of support that will top up your account balance by up to 5% of your total Invested Amount over the life of your term.

Read more about our support mechanisms HERE.

Easy. Quick. Seamless. Your TermPlus Account has its own easy-to-use account dashboard from where you can manage and track your applications, get an overview of your accounts, track your earnings and access tax statements etc.

Your Income payments are based on the starting balance of your Account. You have the option of adding Income payments to your account balance, which means that they will accrue additional Income in following months. If you would like to add new funds to earn Income, this can be done by opening another Term Account using the ‘add account’ button on your dashboard. As this is a ‘term based’ account, funds cannot be withdrawn until the Term is over.

You have 2 choices as to what is to occur at the end of the Term.

- Rollover into a new Term

- Withdraw your balance to be paid back into your bank account, this would include any income reinvested through the course of your term account.

You also have the option to do a partial withdrawal and partial rollover.

End of term elections need to be made by the due date that is noted on your account in the customer dashboard.

The TermPlus Target Market Determinations note an indicative risk level of Low to Medium (that is, over any 20 year period, we consider that TermPlus is likely to experience between 1 and less than 2 years of negative annual returns). Private credit (the underlying asset class held by TermPlus accounts) benefits from lender protections, such as contractual limitations and covenants on the borrower, payment priority to the lender, and valuation methodologies that can look through shorter-term market volatility. These enhanced protections have historically resulted in lower default rates and higher recovery rates for private credit assets relative to other credit alternatives. It is however important to understand that the value of your investment may go down. You should consider all the risks involved and whether they are appropriate for your objectives and financial circumstances. The Income paid and maintenance of your initial investment will depend on the performance of the investments made by TermPlus and no guarantees can be made regarding either. Past performance is not a reliable indicator of future performance.

We have sought to mitigate these risks further, through the Priority Income, Income Stabilisation, and Savings Support mechanisms.

A complete summary of all possible risks and protection mechanisms is available in the TermPlus PDS.

Need to Know More?

Click here to contact our client service or simply call 1300 883 881 for assistance.